ABI December 2024: Business conditions end the year on a weak note

More than one-quarter of firms report that significantly delayed projects are increasing

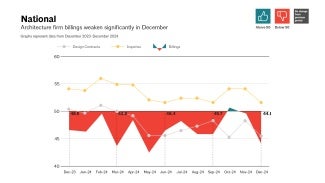

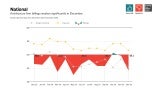

Business conditions at architecture firms weakened significantly in December, following two months of better conditions.

The AIA/Deltek Architecture Billings Index (ABI) score fell to 44.1 for the month as the share of firms reporting a decline in firm billings increased. Firm billings have now decreased for the majority of firms every month except two since October 2022. While not a full-fledged recession, this period of softness and uncertainty has been challenging for many firms. And prospects for future work remain soft as well. Although inquiries into new projects continued to increase at a relatively slow rate, the value of newly signed design contracts decreased further in December as clients remained hesitant to commit to new work. In one brighter spot, backlogs at firms remained steady and strong at 6.5 months in December, so many firms still have work in the pipeline for now.

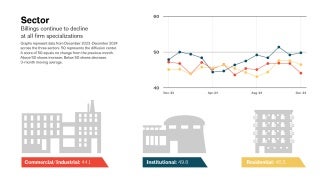

Despite overall softness in billings, firms located in the West reported growth for the third consecutive month in December. But business conditions remained soft for firms in all other regions, particularly at firms located in the Northeast, which were the first to report slight growth earlier in the year. Billings also declined at firms of all specializations in December, although firms with an institutional sector are on the cusp of growth and have been for several months. However, business conditions softened further for both firms with multifamily residential and commercial/industrial specializations this month, ending the year on a down note.

Inflation remains a concern

Conditions in the broader economy also remain mixed, with robust national employment growth but resurgent concerns about lingering inflation and its impact. Total nonfarm payroll employment grew by an additional 256,000 positions in December, for a total growth of 2.2 million new positions for 2024. However, in November (the most current data available), architecture services employment softened further, shedding 1,300 jobs. More than 4,000 jobs have been lost in the industry since November 2023, and employment has fallen to the lowest level since 2022, although it remains higher than it was pre-pandemic. In addition, the University of Michigan’s most recent Index of Consumer Sentiment results show a spike in consumer concern about inflation over the next six months, after that had significantly decreased in recent months once the Federal Reserve started lowering interest rates. With inflation remaining stubborn over the last few months, the Federal Reserve has now signaled that they are unlikely to lower rates further in the near future, which could affect the availability of credit to finance projects.

Construction budget issues leading to stalled, delayed, and canceled projects

This month, we asked firm leaders about trends in delayed, stalled, and canceled projects at their firm over the past six months. Overall, a majority of responding firm leaders reported that the shares of delayed, stalled, and canceled projects at their firm are generally stable. However, slightly more than one-quarter of firms (26%) reported that the share of significantly delayed projects is increasing, while 23% reported that the share of projects on hold/indefinitely stalled is increasing, and 18% reported that the share of canceled/abandoned projects is increasing. Generally, few firms indicated that the share of these types of affected projects has declined recently, but 17% did say that the share of canceled projects has decreased in the last six months. Firms with a commercial/industrial specialization were generally most likely to report that the share of delayed, stalled, and canceled projects has been increasing, with more than one-third (34%) reporting that the share of delayed projects has increased, 31% that the share of stalled projects has increased, and 24% that the share of canceled projects has increased.

However, the overall share of recent projects affected by issues has remained relatively small. Responding firm leaders indicated that 72% of their projects, on a dollar basis, are proceeding as normal. Just 4% are canceled/abandoned, while an average of 10% are on hold/indefinitely stalled, and 14% are significantly delayed. Firms with a multifamily residential specialization reported the highest share of delayed projects (17%) versus 15% of projects at firms with a commercial/industrial specialization and 11% of firms with an institutional specialization.

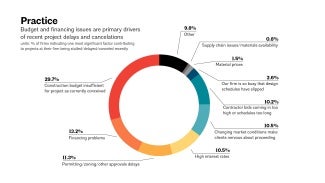

When asked about contributing factors to stalled/delayed/canceled projects at their firm, the one most commonly cited issue by firm leaders was a construction budget insufficient for the project as currently conceived, selected by 53% of responding firm leaders. Other issues cited included contractor bids coming in too high or schedules too long (40%), financing problems (39%), changing market conditions making clients nervous about proceeding (39%), permitting/zoning/other approvals delays (38%), and high interest rates (31%). When asked to select the one most significant factor contributing to recent stalled/delayed/canceled projects at their firm, nearly one-third (30%) selected insufficient construction budget. Financing problems was second, with 13% selecting it as the one most significant factor, followed by permitting/zoning delays (11%), high interest rates (11%), client nervousness due to changing conditions (11%), and high contractor bids (10%). Very few firms reported that supply chain issues and material prices/availability were a significant factor contributing to recent project delays.

Finally, when asked about trends in stalled, delayed, and canceled projects for the first six months of 2025, as compared to the past six months, more than half of firms (60%) expect the trend to remain about the same, while 28% expect that it will be lower, and just 12% expect that it will be higher. However, more firms in the Northeast (19%) and Midwest (15%) expect an increase in stalled/delayed/canceled projects in the first six months of 2025 than in other regions.

- Join us for FREE at the next AIAU live webinar, Economic Update: Q4 2025 ABI Insights, on Thursday, November 20, 2025, at 2pm ET.

This month, Work-on-the-Boards participants are saying:

- “Philadelphia, and the east coast in general, do not get the same wild economic swings, since they are anchored by many large institutions.”—42-person firm in the Northeast, institutional specialization

- “We work nationally, and had very healthy inquiries in December, which is usually a slow month. Hoping that converts into new projects in the first quarter.”—130-person firm in the Midwest, commercial/industrial specialization

- “Still flat, but expectations seem to be for some improvement in 2025.”—28-person firm in the West, multifamily residential specialization

- “We have not received any inquiries for new work in months.”—4-person firm in the South, institutional specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.