ABI February 2024: Pace of billings decline continues to slow

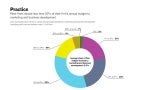

Architecture firms spend an average of 6% of their annual budget on marketing and business development.

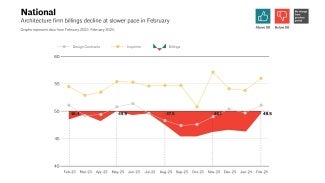

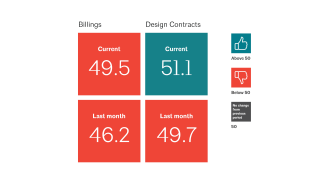

Although architecture firm billings declined for the thirteenth consecutive month in February, the AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month means that the share of firms reporting a decline in billings was nearly equal to the share of firms that reported an increase in billings.

This is the closest to 50 that the ABI score has been since last July (a score over 50 indicates billings growth) and suggests that the recent slowdown may be receding. In addition, inquiries into new projects grew at their fastest pace since November, and the value of newly signed design contracts increased as well. This is just the fourth time that design contracts have increased in the last year and is a good indicator that work at firms may begin picking up in the coming months.

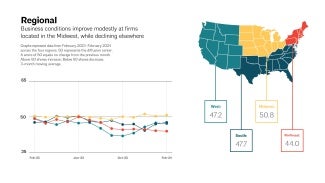

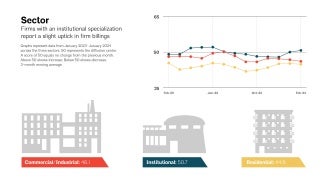

Business conditions remained generally quite weak across the country in February. Only firms located in the Midwest reported billings growth, while business conditions softened further at firms located in the Northeast. Conditions also remained generally slow at firms located in the West and South. However, firms located in the Midwest have reported growth for the last three months, and for four months out of the last five. Billings also continued to decline at firms with multifamily residential and commercial/industrial specializations in February, although they increased modestly at firms with an institutional specialization for the first time since last July.

Architectural services employment posts strong gains in early 2024

Economic activity in the broader economy increased slightly in most regions of the country in February, according to the latest edition of the Federal Reserve’s Beige Book report, released on March 6. In addition, the outlook for future economic growth is generally positive. The demand for residential real estate has increased in many areas recently as mortgage rates have moderated somewhat, notably in the Boston, Richmond, Minneapolis, and San Francisco districts, although home sales have declined slightly in the Atlanta district. Commercial real estate remains generally weak, slowing in the Atlanta and Minneapolis districts over the last few weeks. The softness is most notable for office buildings, but there is still strong demand for data centers and manufacturing facilities. In a more positive sign, the cost of many construction inputs has fallen in recent weeks, and so far, there has been negligible impact from shipping concerns due to ongoing disruptions in the Red Sea and Panama Canal.

Employment also continued its upward trajectory in February, with total nonfarm payroll employment growing by 275,000 positions. In addition, the construction industry added 23,000 new jobs, slightly above the average monthly gains of 18,000 over the previous year. Architectural services employment posted strong gains of 1,000 new positions in January, the most recent data available, and the largest monthly gain since June 2023.

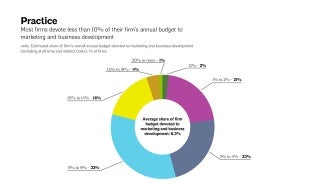

Uncompensated design concept work stretches some firms’ budgets

This month’s special practice questions followed up on the marketing and business development question that was asked last month. This month, responding architecture firm leaders reported that an average of 6.3% of their overall annual budget is devoted to marketing and business development, including both staff time and indirect costs. Fewer than 10% of firms reported that it was more than 15%. Larger firms reported a slightly higher share of their budget devoted to these activities, for an average of 7.1% at firms with annual billings of more than $5 million, versus 4.7% at firms with annual billings of less than $250,000.

More than two-thirds of firms (69%) indicated that at least some of their firm’s marketing and business development efforts consist of client-requested design concept work that should be compensated. This was significantly higher at large firms, where 80% reported this, versus just 52% of small firms. At firms that indicated that at least some of their firm’s marketing and business development efforts consist of client-requested design concept work that should be compensated, these requests accounted for an average of 10.8% of their total marketing and business development efforts. This was highest for firms with a multifamily residential specialization, who reported that it accounted for an average of 13.4% of their marketing and business development efforts, in contrast to 11.9% at firms with a commercial/industrial specialization, and 8.1% at firms with an institutional specialization.

Overall, 61% of firms reported that residential/commercial developers clients tend to request significant non-compensated design concept work as part of the marketing and business development process, followed by institutional non-profit clients (37%), residential/commercial owners (32%), governmental (22%), and institutional private (20%). Firms also indicated that new clients were more likely than repeat clients to request non-compensated design concept work as part of the marketing and business development process (35% versus 16%), but nearly half of firms (49%) indicated that both new and repeat clients are equally as likely to request this type of work.

This month, Work-on-the-Boards participants are saying:

- “We are starting to see an uptick in new opportunities in our markets. However, we still have shovel-ready projects looking for financing.”—30-person firm in the Midwest, residential specialization

- “Interest rates are significantly impacting private development.”—135-person firm in the Northeast, mixed specialization

- “Business is still slow for new projects. Money is tight for developers and owners, and there is not much lending.”—15-person firm in the South, commercial/industrial specialization

- “We are staring at a project volume cliff in the next two months, with few prospects for recovery, despite a full funnel. Projects in the funnel are slow to start, delayed, or capital-constrained. Backlogs are strong at six months, though the majority is construction administration work. Firm cost-cutting measures are likely.”—17-person firm in the West, institutional specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.