ABI January 2024: Business conditions remain soft at architecture firms to start the year

For the second consecutive month, business conditions remained weak at firms in all regions of the country except the Midwest, where modest growth was seen.

With business development becoming more challenging, more than one-third of firms report increased spending on marketing over the last year

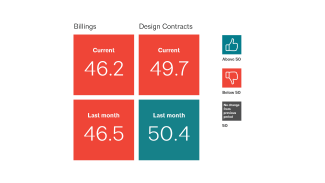

Architecture firm billings remained sluggish to start 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January (any score below 50 indicates a decline in billings). Billings at firms have declined for twelve straight months, as some of the scores from 2023 that initially showed modest growth were revised downward this month during the annual revision to the ABI data. This now marks the lengthiest period of declining billings since 2010–2011, although the pace of this decline is slower. However, inquiries into new projects continue to grow, while the value of newly signed design contracts remains generally flat. While neither of these are signs of immediate growth, they indicate that clients remain interested in new projects, they just are not yet prepared to commit to them.

For the second consecutive month, business conditions remained weak at firms in all regions of the country except the Midwest, where modest growth was seen. Firms located in the Midwest have now reported billings growth for three of the last four months. On the other hand, billings continued to soften further at firms located in the Northeast, reporting the lowest level in three years. Billings also declined at firms of all specializations in January, remaining softest at firms with a multifamily residential specialization.

Broader economy shows improved conditions

Despite the ongoing softness in the architecture industry, conditions continued to improve in the broader economy in January. Nonfarm payroll employment grew by an additional 353,000 new positions in January, and architecture services employment added 200 new positions in December (the most recent data available). After annual revisions to the data, architectural services employment stood at 206,300 at the end of 2023, with a net gain of 1,700 positions for the year, despite shedding 2,000 positions in the August through October period.

Consumers are also experiencing improved conditions recently. The Consumer Price Index (CPI), a measure of inflation, rose by just 0.3% in January, and 3.1% from one year ago. While this is still higher than many would like, it is significantly below the 6.4% annual growth rate seen one year ago. And with inflation continuing to wane, the University of Michigan’s Index of Consumer Sentiment rose by a whopping 13% in January, following growth of 14% in December. The index reached its highest level since July 2021, as consumers are increasingly confident that inflation will continue to soften in the coming months.

Most firm leaders report that biz development spending has increased or remained steady

This month’s special practice questions asked about recent marketing and business development activities at architecture firms. Responding firm principals reported that, on average, their firm’s marketing and business development spending at their firm has either increased (34%) or remained at the same level (51%) as one year ago, with just 15% reporting that it has decreased in that time. Small firms with annual billings of less than $250,000 were least likely to report an increase, with just 13% reporting one, while 67% reported that spending remained about the same, and 20% reported that it decreased.

Compared to a year ago, nearly all responding firm leaders indicated that business development at their firm is either more challenging (47%), or about the same level as one year ago (47%), with just 6% indicating that they find it less challenging now. Larger firms were somewhat more likely than small firms to report that they find business development at their firm more challenging now than it was a year ago. However, most firms believe that their firm’s marketing effort over the last year has been at least somewhat effective (84%), with nearly half (49%) rating effectiveness as a four or five on a five-point scale, where five indicates “very effective.” Larger firms with annual billings of $5 million or more were more likely to consider their marketing effort to be effective (60% rated as a four or five), while small firms with annual billings of less than $250,000 were most likely to believe that their marketing effort has not been that effective (32% rated as a one or two, with one being “not very effective”).

Overall, responding firm leaders reported an average project “hit rate” of 49% over the past six months, on a dollar weighted basis (i.e., the estimated value of projects won as a % of estimated value of total projects bid on). Smaller firms reported a slightly higher hit rate (55% for firms with annual billings of less than $250,000 and 59% for firms with annual billings of $250,000 to $999,999), while larger firms reported an average hit rate of 46%. Some firms noted in the comments that their hit rate is always 100%, because they only bid on projects when they know they will be selected.

Finally, when asked about the share of their firm’s staff time that goes to non-compensated services as a form of marketing to prospective clients, firms reported an average share of 6.6% of their billable hours to these types of services. However, many indicated that that share was higher: nearly three in ten responding firms (29%) indicated that the share was 5% to 9%, 16% indicated that the share was 10% to 14%, and 8% indicated that the share was 15% or more.

This month, Work-on-the-Boards participants are saying:

- “Still many projects under design and being permitted. Very difficult to find equity to move projects forward into construction.”—53-person firm in the Northeast, residential specialization

- “Many small firms that I talk to say the work is steady and consistent; that rare point where it’s not overwhelming or underwhelming.”—7-person firm in the Midwest, mixed specialization

- “Steady, but there is a fair amount of skepticism about 2024 as the markets seem in flux and venture capital is expensive.”—2-person firm in the South, commercial/industrial specialization

- “I am concerned that supply chain issues will start to emerge with shipping challenges at the Suez and Panama canals.”—35-person firm in the West, institutional specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.