ABI January 2025: Architecture firm billings remain soft to start the new year

Nearly all responding firms report that they pay for AIA membership for eligible staff.

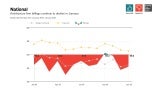

Business conditions remained broadly soft at architecture firms in January

The AIA/Deltek Architecture Billings Index (ABI) score was 45.6 for the month, slightly above the December score. This means that while a majority of firms still saw their billings decrease in January, the share of firms experiencing that decrease was slightly smaller than in December. Inquiries into new projects continued to grow at the same slow pace as in recent months, but the value of newly signed design contracts declined for the eleventh consecutive month as clients remained cautious about committing to new projects during the ongoing economic uncertainty. (Note that every January, the seasonal adjustment factors for all ABI data series are revised, leading to revisions in recent historical data.)

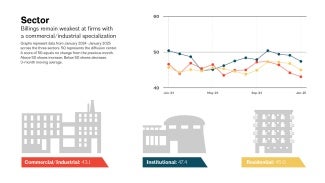

Billings were also soft at firms in all regions of the country in January. Firms located in the West saw very modest billings growth in the fourth quarter of 2024, but unfortunately, billings returned to negative territory to start the new year. Business conditions remained softest at firms located in the Northeast, which has been the trend in recent months. And billings softened further at firms located in the South, which saw more encouraging signs last fall, before weakening again. Billings also declined at firms of all specializations in January. Firms with a commercial/industrial specialization continued to be most likely to report softening business conditions, but billings have weakened at firms of all specializations in recent months.

Architecture firms report strong hiring to end 2024

Conditions remained somewhat soft in the broader economy as well in January. Inflation in January was higher than anticipated, with the Consumer Price Index (CPI) increasing by 0.5% from December and 3.0% from one year ago, the highest level since last June. Inflation growth in January was primarily due to increases in energy and food prices, as well as core goods (like used vehicles) and services (e.g., shelter away from home). Recently the Federal Reserve has signaled reluctance to lower interest rates further in the short term, and they will remain even less likely to do so if inflation remains at this higher level.

Nonfarm payroll employment added 143,000 new positions in January, modestly below the average monthly increases of 166,000 in 2024. However, architecture services employment ended 2024 on a strong note after shedding jobs in the fall, adding 2,200 new positions in December (the most recent data available). This amounts to a net loss of 1,400 positions for 2024, as employment at architecture firms has declined by a total of 4,100 positions since the post-pandemic peak in June 2023.

Nearly all architecture firms pay for membership dues/licensure fees for their staff

This month we asked firm leaders about their support of membership dues and licensure fees for their architecture staff. Overall, 85% of responding firm leaders indicated that they pay membership dues/licensure fees for their staff in some capacity, increasing to nearly all large firms with annual billings of $5 million or more (97%). Nearly all firms (98%) reported that they pay for AIA membership dues (82% in full, 16% in part), followed by 93% that pay for professional accreditation/certification fees (65% in full, 28% in part), 91% that pay for licensure fees (75% in full, 16% in part), 85% that pay for NCARB fees (65% in full, 20% in part), and 84% that pay for professional membership dues (other than AIA, NCARB) (55% in full, 29% in part).

Overall, responding firm leaders reported that an average of 69% of the architecture staff at their firm that are eligible for membership are members of AIA. This is highest at firms with an institutional specialization (72% of eligible staff are members) and lowest at firms with a multifamily residential specialization (59% of eligible staff are members). In addition, a majority of firms (72%) also reported that, in general, a fairly stable share of architecture staff at their firm has remained AIA members over the past five to 10 years. Just 14% indicated that a smaller share of architecture staff at their firm are members now than five to 10 years ago, while an additional 14% reported that a higher share of architecture staff at their firm are members now than five to 10 years ago.

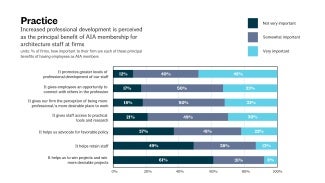

Finally, when asked to rate the importance of the principal benefits of having eligible employees as AIA members, nearly half of responding firm leaders (48%) rated the promotion of greater levels of professional development of their staff as a very important benefit, while an additional 40% rated it as a somewhat important benefit. Responding firm leaders also highly rated giving employees an opportunity to connect with others in the profession (33% rated as very important, 50% as somewhat important), giving their firm the perception of being more professional/a more desirable place to work (32% rated as very important, 50% as somewhat important), and giving staff access to practical tools and research (30% rated as very important, 49% as somewhat important). Firms rated helping them to win projects and win more desirable projects, helping retain staff, and helping advocate for favorable policy as less important benefits to having eligible employees at their firm as AIA members.

- Join us for FREE at the next AIAU live webinar, Economic Update: Q4 2025 ABI Insights, on Thursday, November 20, 2025, at 2pm ET.

This month, Work-on-the-Boards participants are saying:

- “Trending up in December, flattened in January. Concerns from all corners of the AEC community about cost escalations caused by tariffs.”—37-person firm in the West, mixed specialization

- “Business conditions for January have improved as compared to 2024.”—75-person firm in the South, commercial/industrial specialization

- “Across most practice areas, inquiries are down and project delays are common, due to uncertainty in the financial world and construction costs.”—30-person firm in the Northeast, residential specialization

- “Declining due to the cost of construction and delayed schedules.”—4-person firm in the Midwest, institutional specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.