ABI July 2024: Firm billings decline at modestly slower pace

Nearly half of architecture firm leaders say that length of time for design activities has increased in recent years

Architecture firms reported declining billings for the eighteenth consecutive month in July.

While the ABI/Deltek Architecture Billings Index (ABI) score of 48.2 for the month indicates that fewer firms reported a decline in billings in July than in May, it still means that more than half of responding firms this month are still experiencing soft business conditions. As far as future work in the pipeline at firms, the value of newly signed design contracts decreased for the fourth consecutive month in July, but the pace of that decline slowed as well. In addition, inquiries into new projects continued to increase this month, although that growth continued at the same slow pace they have been growing at for much of the year so far.

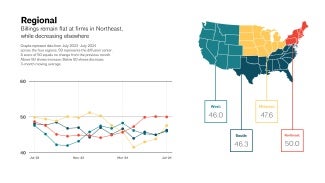

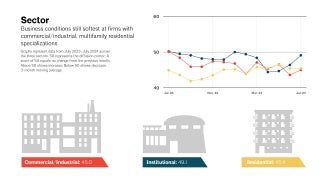

Regionally, architecture firm billings were flat for the second consecutive month at firms located in the Northeast in July, marking the first two-month period with a score at or above 50 for the region since mid-2022. Billings declined at firms in all other regions this month, but the pace of the decline slowed in all of them. Business conditions also remained soft at firms of all specializations in July, although there were some notably encouraging signs at firms with an institutional specialization, where billings were nearly flat.

Moderate softness grows in the larger economy

Conditions softened somewhat in the broader economy as well this month. Nonfarm payroll employment added just 114,000 new jobs in July, well below the average of 215,000 in the previous 12 months. In addition, the unemployment rate continued to tick up, rising to 4.3%, up nearly one full point from a year ago when it was 3.5%. However, construction employment remained robust this month, with the industry adding 25,000 new jobs. And the architectural services industry added 2,100 new positions in June (the most current data available), rising to total industry employment of 206,300, the highest level since August 2023.

The latest edition of the Federal Reserve’s Beige Book report, released on July 17, also showed that growth across the country moderated in June and early July, with five of the 12 districts reporting flat or declining activity during that period. Overall expectations are for slower growth during the next six months due to uncertainty around the election, domestic policy, geopolitical conflict, and inflation. Regionally, home sales were generally soft, notably in the New York, Atlanta, Dallas, and San Francisco districts. In the Boston district, residential real estate activity increased, but commercial was flat due to concerns over office leasing activity. And while commercial and residential construction improved modestly in the Minneapolis district, home sales remained more mixed there too.

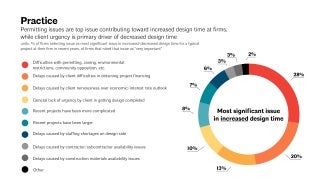

Many firms have experienced lengthier design times recently

This month we asked firm leaders about how the length of time for design services has changed at their firm over the past several years. Overall, nearly half of responding firm leaders (43%) indicated that the length of time for design activities has increased in recent years, with 20% saying that it has increased a lot. Nearly one-quarter of firm leaders (23%) said that the length of time for design activities has decreased, while the remaining 34% said that it has stayed about the same. Firms with a multifamily residential specialization were much more likely to report that the length of time for design activities has increased (56%) than firms with institutional (36%) or commercial/industrial (41%) specializations.

At firms where design time for typical projects has increased in recent years, 54% rated difficulties with permitting, zoning, environmental restrictions, community opposition, etc. as a very important reason for that increase. On the other hand, most firm leaders said that larger recent projects (56%), delays caused by staffing shortages on the design side (55%), and delays caused by construction materials availability issues (46%) were not very important factors in increased design time. Overall, 28% of firms indicated that difficulties with permitting, zoning, environmental restrictions, community opposition, etc. was the one most significant issue in increased design time, followed by 20% who selected delays caused by client difficulties in obtaining project financing as the one most significant issue. And while just 6% of firms indicated that staffing shortages on the design side were the most significant issue in increased design time, 22% of firms located in the Northeast, and 16% of firms with an institutional specialization, selected this as the most significant issue.

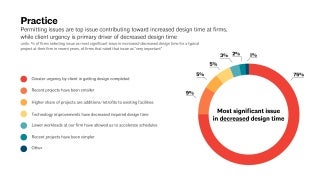

At firms where design time for typical projects has decreased in recent years, more than two-thirds of responding firm leaders (68%) indicated that greater urgency by clients in getting design completed was a very important factor in the decrease in design time. In contrast, most respondents said that lower workloads at their firm allowing them to accelerate schedules was not an important factor (69%), nor was simpler recent projects (61%). Overall, three-quarters of responding firm leaders selected greater urgency by clients in getting design completed as the one more significant issue in decreased design time in recent years. Just 10% of firms overall selected smaller recent projects as the primary reason for decreased design time, but 33% of firms with a multifamily residential specialization, 27% of firms with a commercial/industrial specialization, and 25% of firms located in the West selected it as the primary reason. In addition, just 5% of firms overall selected a higher share of projects that are additions/retrofits to existing facilities as the primary reason for decreased design time, but 18% of firms with a commercial/industrial specialization selected it as the primary reason.

This month, Work-on-the-Boards participants are saying:

- “Projects are going on hold. Projects are re-designing to lower costs. Permits are difficult to obtain.”—71-person firm in the South, commercial/industrial specialization

- “Variable. Things are still moving, but in fits and starts. Small, less risky projects are going forward, but more substantial projects that have higher risk of cost overruns are stalling.”—31-person firm in the Midwest, institutional specialization

- “Higher interest rates do not seem to have slowed the pace of construction, but it has eliminated the “tire kickers.” Most clients are now serious about their projects, and most have a significant amount of cash to fund the project, not heavily relying on financing.”—9-person firm in the West, residential specialization

- “No big projects coming in, just small ones that are hard to profit from.”—9-person firm in the Northeast, commercial/industrial specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.