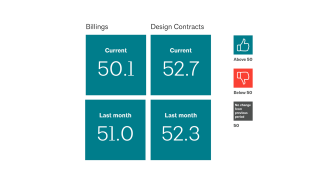

ABI June 2023: Firm billings remain essentially flat

Business conditions held steady at architecture firms with an ABI score of 50.1—indicating slight billings growth. Although June was a weaker month than May, it marks the first two consecutive months of increased billings since last fall.

While few firm leaders report using AI currently, 90% expect to increase usage over the next three years

Business conditions generally held steady at architecture firms in June, as the AIA/Deltek Architecture Billings Index (ABI) score of 50.1 continued to indicate slight billings growth at firms. This also marked the first time since last fall that there have been two consecutive months of increasing billings at architecture firms, although growth in June was weaker than in May. Inquiries into new work remained fairly strong as well, as did the value of new signed design contracts, which saw their strongest growth since January. While firm backlogs have decreased somewhat from their record-high levels in 2022, they remain robust—averaging 6.8 months.

Firms in nearly all regions of the country also reported improving business conditions in June, with firms located in the Midwest continuing to see the strongest billings for the eighth consecutive month. Billings growth also resumed at firms located in the Northeast, following monthly declines since last October. Conditions remained more mixed by firm specialization, however, as firms with multifamily residential and commercial/industrial specializations continued to report softness. However, billings continued to grow at firms with an institutional specialization this month, reaching their highest level since the immediate post-pandemic recovery period.

Inflation continues to slow

Conditions in the broader economy remained generally strong in June, as inflation continued to moderate and hiring continued apace. The Consumer Price Index (CPI) showed that consumer prices increased by just 0.2% from May to June, while the rate of growth from one year ago slowed to 3.0%, the lowest annual growth rate since March 2021, and far below the 9.1% annual growth rate seen one year ago. Although housing rental prices remain high; airfare, hotel, and food prices have declined considerably in recent months. However, since the current 3% inflation rate remains above the Federal Reserve’s target rate of 2%, there remains uncertainty as to whether they will raise rates further during their next meeting later this month or pause again instead.

Nonfarm payroll employment also continued to rise at a steady pace in June, with 209,000 new positions added. While this is below the average monthly growth rates seen in 2022, it still indicates healthy growth in the labor market. Architecture services employment added an additional 1,300 positions in May (the most recent data available), the largest monthly growth seen since last November. Employment in the industry currently stands at 202,600.

Many firm leaders are intrigued by possible applications of AI at their firm

This month’s special practice questions asked firm leader about their firm’s current and projected future use of artificial intelligence (AI). Overall, just 5% of responding firm leaders indicated that they are currently using AI at their firm in their daily operations, although this share rises to 10% of large firms with annual billings of $5 million or more and 7% of firms with an institutional specialization. Nearly one-fifth of firm leaders (17%) indicated that they don’t currently see any useful applications of AI at their firm at present, including one-third of those at small firms with annual billings of $250,000 or less. However, a majority of other firms are interested in possible applications of AI at their firm, with 40% indicating that they are intrigued by the potential of AI, but don’t currently see any practical applications, and 29% indicating that they are currently investigating some potential applications of AI at their firm.

As for the small share of firms currently using AI, the most common activities for which it is being used are to provide design options (conceptual/design development) and for marketing/market development. Some firms are also currently using it for finance/administration tasks and strategic planning. Looking to the future, 38% of firm leaders (excluding those that do not currently see any useful applications of AI at present) indicated that they see the most long-term potential of AI at their firm for design options, followed by marketing/market development (35%), zoning and code compliance (34%), and material/product selection/specification (28%).

Despite few firms using AI at present, 90% of responding firm leaders expect to increase their usage of it over the next three years, with 27% projecting their usage will increase significantly, 31% that it will increase moderately, and 32% that it will increase slightly. Large firms (32%) and firms with a multifamily residential specialization (29%) were most likely to anticipate a significant increase in their usage over that period.

What ABI June 2023 Work-on-the-Boards participants are saying

- “Business conditions seem to be positive across the country. We are seeing a large volume of data center work.” —105-person firm in the West, mixed specialization

- “Things seemed to be ramping up, but stalled again.” —20-person firm in the Midwest, institutional specialization

- “High interest rates are pushing some projects into ‘go slow’ mode.” —5-person firm in the Northeast, residential specialization

- “Business is hot and cold. We remain optimistic and busy currently, but have seen other industry forecasts that predict a future decline, so we remain cautious.” —4-person firm in the South, commercial/industrial specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.