ABI March 2024: Architecture firm billings retreat further in March

Nearly half of firm leaders think that negotiating project design fees is more challenging now than it was 4–5 years ago

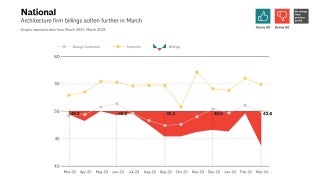

Business conditions at architecture firms softened in March, as the AIA/Deltek Architecture Billings Index (ABI) score declined to 43.6 for the month.

This marked the 14th consecutive month of declining billings at firms as inflation, supply chain issues, and other economic challenges continue to affect business. While inquiries into new projects have continued to grow during that period, it has been at a slower pace than in 2021 and 2022. More notably, the value of new signed design contracts was flat in March, which has generally been the trend for the last year and a half. This shows that clients are interested in starting new projects but remain hesitant to sign a contract and officially commit to those projects. However, most firms report that they still have strong project backlogs of 6.6 months, on average, so even with the ongoing soft patch, they still have work in the pipeline.

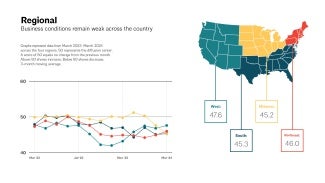

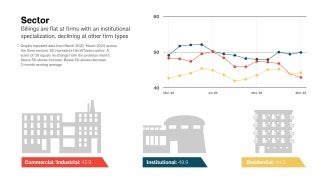

Architecture firm billings also continued to decline at firms in all regions of the country, and at firms of all specializations in March, just like in February. Regionally, business conditions were softest at firms located in the Midwest and South. By specialization, billings declined faster at firms with a commercial/industrial specialization and remained weak at firms with a multifamily residential specialization. However, firms with an institutional specialization reported billings that were essentially flat, marking the third straight month of that trend.

Despite recent declines, inflation remains pervasive

Conditions remained generally mixed in the broader economy in March. Employment remained a bright spot, with nonfarm payroll employment increasing by 303,000 new positions. Construction was one of the strongest sectors, adding 39,000 new positions, after averaging monthly gains of 19,000 over the previous 12 months. However, architecture services employment was flat at 206,100 in February (the most recent data available). Although employment in the industry increased in January, it has generally been flat or declining every month since the strong gains in early 2023.

Despite recent declines, inflation remained pervasive in March, with the Consumer Price Index (CPI) rising by 0.4% from February and 3.5% from March 2023. While this growth is well below the record high levels seen in 2022, it remains more elevated than had been expected by this point in the cycle. Higher energy and shelter prices were the primary contributors to the increase this month. Because inflation has not yet returned to ideal levels, it seems likely that the Federal Reserve will hold off on starting to reduce interest rates until the third quarter of the year, according to Wells Fargo.

Hourly rate and stipulated sum remain most popular structure for design fees

This month’s special practice questions asked firms about topics related to their firm’s profitability, which is always a key concern for architecture firms. Overall, just under half of responding firm leaders (46%) reported that negotiating design fees for projects is more challenging now than it was 4–5 years ago, with 14% saying that it is much more challenging, and 32% saying that it is somewhat more challenging. Large firms were somewhat more likely than small firms to report that negotiating design fees is more challenging now. Just 12% of firms indicated that negotiating design fees is less challenging now, while 42% reported that it is about the same now as it was 4–5 years ago.

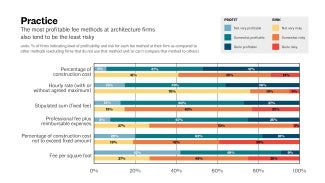

Responding firm leaders were most likely to report using hourly rate (with or without agreed maximum) (used by 93% of firms) and stipulated sum (fixed fee) (used by 92% of firms) fee determination methods for their design fees, with 42% using hourly rate regularly and 50% using it occasionally, and 70% using stipulated sum regularly and 18% using it occasionally. While slightly fewer firms reported using the professional fee plus reimbursable expenses method (80%), 60% reported using it regularly. Just 28% of firms reported using the percentage of construction cost not to exceed fixed amount method, and 30% reported using the fee per square foot method.

Hourly rate is likely the most commonly used method because firms that use it consider it to be both profitable (49% said that it is somewhat profitable, 36% said that it is very profitable) and low risk (76% said that it is not very risky). Stipulated sum is also considered to be generally profitable by firms that use it, but nearly one quarter of responding firms (23%) indicated that it is quite risky. And 39% of responding firms that use the percentage of construction cost not to exceed fixed amount method said that they consider to be very risky, which is likely why few firms choose to use it.

In terms of profitability, responding firms that serve these client categories indicated that corporate business, commercial, or industrial companies tend to be most profitable (37% said that projects for this type of client are quite profitable, 57% that they are somewhat profitable), followed by private institutions (e.g., for-profit hospitals, private schools) (38% quite profitable, 52% somewhat profitable); other architects, engineers, design professionals, or construction companies (including design-build) (20% quite profitable, 63% somewhat profitable); and federal government, state, or local government (including public schools) (38% quite profitable, 45% somewhat profitable). While 51% of firms indicated that projects for developers/private individuals are somewhat profitable, more than one quarter (28%) reported that they are not very profitable. And nearly half of firms (44%) said that projects for non-profit organizations or institutions (e.g., non-profit schools and hospitals, museums, churches) are not very profitable, while 45% said that they are somewhat profitable.

Finally, responding firms reported average annual net pre-tax, pre-bonus profits as a percentage of net service revenue of 11.5% over the past few years. Just 9% of firms reported a loss or profits of less than 5%, while 31% reported profits of 5% to 9%, 33% reported profits of 10% to 14%, and more than one quarter (27%) reported profits of 15% or more. Profits averaged somewhat higher at large firms (an average of 14.1% at firms with annual billings of more than $5 million) than at small firms (an average of 9.0% at firms with annual billings of less than $250,000).

For more information about the data on fees and profitability in this article, please join us AIA24 for the session Figuring Out Fees: Consideration of Services Offered & Project Complexity (FR218) on June 7, 2024 from 2–3:30pm. Register and learn more at: https://conferenceonarchitecture.com/

And join us for FREE at the AIAU live webinar Economic Update: Q2 2024 ABI Insights on Thursday, April 25, 2024 at 2pm ET. Register and learn more at: https://aiau.aia.org/theme/aiau/details.php?id=1162

This month, Work-on-the-Boards participants are saying:

- “Improved in the fourth quarter of 2023, but flattened since–no decline or uptick.”—24-person firm in the Midwest, residential specialization

- “Hesitant–we have a few jobs either awarded as part of a design-build effort or as the designer on projects that have been held up as companies go through a lot of review and budgeting re-review.”—16-person firm in the South, commercial/industrial specialization

- “The economy within our sector of work is still relatively strong, but clients are more conscious about construction costs and fee structures.”—14-person firm in the West, institutional specialization

- “There are a lot of requests for proposals, and about 35-40% of proposals become projects. Conditions seem good, just very difficult to receive payments.”—4-person firm in the Northeast, residential specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.