ABI November 2024: Architecture firm billings remain flat

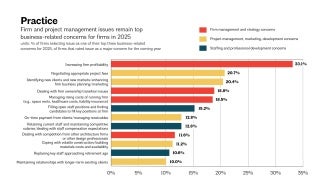

One-third of architecture firm leaders rate increasing firm profitability as one of their top three biggest business concerns for 2025

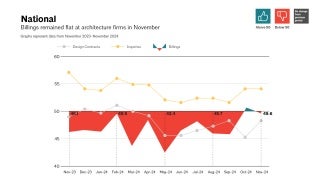

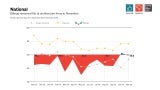

Architecture firm billings remained flat in November.

Despite the AIA/Deltek Architecture Billings Index (ABI) score dipping slightly below 50 for the month, it remains close enough to that threshold to indicate that the share of firms that reported declining billings was essentially the same as the share that reported increasing billings. Although it would be better to see the majority of firms reporting growth, the fact that billings have returned to flat after declining for nearly two full years is an encouraging sign that conditions are improving for more firms. Inquiries into new work continued to grow steadily, and while the value of newly signed design contracts declined for the eighth consecutive month, the pace of that decline slowed this month.

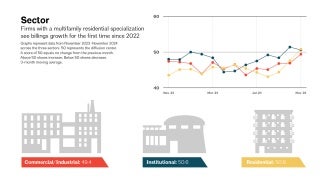

Business conditions continued to improve in the West and South regions of the country in November, where firm billings increased for the second consecutive month. Most notable was the strength of billings growth in the West, where the score was the highest it has been since mid-2022. Although billings continued to decline at firms located in the Northeast and Midwest, the pace of the decline slowed in both regions this month. There was significant improvement in business conditions at firms with a multifamily residential specialization in November as well, where they reported their first increase in billings since August 2022, at the end of the post-pandemic boom. In addition, billings increased for the second consecutive month at firms with an institutional specialization. While billings continued to decline at firms with a commercial/industrial specialization, the pace of the decline slowed significantly.

Despite other improvements in the economy, inflation remains a concern

The broader economy generally improved this month, although there remain some areas of concern. Nonfarm payroll employment added 227,000 new positions in November, a significant turnaround following just 36,000 jobs added in October. Architecture services employment data lags by one month, and the industry shed 100 jobs in October, the most recent data available. However, declines in the sector have stabilized in recent months, following larger decreases earlier this year.

Unfortunately, inflation ticked back up somewhat in November, following improvement in recent months. The consumer price index (CPI) rose by 2.7% from one year ago and by 0.3% from October, the largest monthly increase since April. This month’s primary contributors were gas and grocery price increases, although rent and transportation costs eased modestly. Despite this uptick, it remains highly likely that the Federal Reserve will lower interest rates by another .25 percentage points at their December meeting.

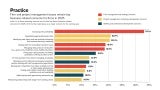

Firm profitability tops the list of firm concerns for 2025, while concerns about project financing subside

This month, we asked architecture firms about their biggest business-related concerns for the coming year. Typically, increasing firm profitability is their top concern, and this year was no exception: one-third of responding firm leaders who rated increasing firm profitability as a major concern for 2025 selected it as one of their top three concerns for the coming year. This is the highest share rating it as their top concern since 2017. In addition, 21% of firm leaders who rated negotiating appropriate project fees as a major concern for the coming year selected it as one of their top concerns. Rounding out the top three biggest concerns was identifying new clients and new markets/enhancing firm business planning/marketing; 20% of firm leaders that rated that issue as a major concern selected it as one of their top three concerns for the coming year, slightly higher than the share that selected it last year (18%).

While staffing issues remain among the top concerns at many firms, the share of firms selecting them as a top concern decreased somewhat from 2024, with 15% of firm leaders selecting filling open staff positions and finding candidates to fill key positions at the firm as a top issue (down from 18%). However, concern over replacing key staff approaching retirement age increased, with 11% rating it as a top concern this year versus 9% last year.

Financing issues also significantly decreased in level of concern for 2025, as interest rates decline and inflation wanes. While 15% of firm leaders rated client challenges in the availability of project financing and higher interest rates as a top concern for 2024, just 7% selected it for 2025. Concerns about managing rising costs of running their firm (e.g., space rents, health care costs, liability insurance) also decreased somewhat for firm leaders this year, with 19% rating it as a top concern versus 22% last year.

Issues of less concern for firm leaders for 2025 included managing possible merger and acquisition activity (65% of firm leaders rated it as not a concern for 2025), increasing firm post-construction work (e.g., post-occupancy analysis and monitoring) on existing buildings (58% rated as not a concern), developing strategies/principles/services for designing buildings for the post-pandemic world (54% rated as not a concern), reducing staffing costs (e.g., cutting hours, reducing headcount) (53% rated as not a concern), and integrating and managing a workforce split between remote and in-office (52% rated as not a concern).

This month, Work-on-the-Boards participants are saying:

- “Things seem to be staying in a positive direction, but no significant changes in conditions.”—74-person firm in the Midwest, institutional specialization

- “New multifamily residential and mixed-use projects are increasing, but our hospitality work is still slow.”—12-person firm in the West, commercial/industrial specialization

- “Project starts and schedules have slipped in the last two months of 2024, but projections for 2025 remain very strong.”—17-person firm in the South, mixed specialization

- “Lots of renovation projects ahead in our market.”—26-person firm in the Northeast, institutional specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.