How firms can reduce tax burdens through credits and incentives

By Brayn Consulting

Get ready for an exciting ride as we gear up for the 2024 tax season — a year that promises to both pose a challenge and present substantial upsides for architecture firms from a tax perspective. Architecture firms can capitalize on lucrative tax incentives, namely the Credit for Increasing Research Activities credit (“R&D Credit”) under Section 41 and the Energy-Efficient Commercial Building Deduction (“179D Deduction”) under Section 179D.

The frameworks governing both incentives have recently undergone significant changes, causing the relative value of the R&D Credit to decrease and that of the 179D Deduction to substantially increase.

With careful tax planning and a keen understanding of these incentives, architecture firms may be able to significantly reduce their tax bill despite continuing challenges on the R&D Credit front.

R&D Credit: Change to mandatory capitalization for Section 174 expenditures

The R&D Credit is a federal tax credit that incentivizes R&D activity by providing a credit for a portion of a business’ qualified research expenses (QREs). Businesses can use the credit to offset their income tax liability on a dollar-for-dollar basis. Notably, almost 40 states also offer a state-level tax credit for firms that undertake R&D activities. By claiming both the federal R&D Credit and its state-level analogue, a taxpayer can reduce its tax liability by between 4% and 12% of their QREs incurred in the taxable year.

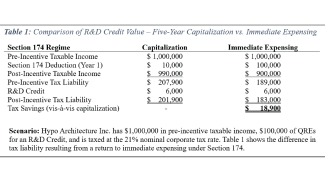

The bad news for R&D Credit claimants is that the Tax Cuts & Jobs Act of 2017 (TCJA) indirectly reduced the value of the R&D Credit via amendments to Section 174. To qualify as a QRE for the purposes of the R&D Credit, an expenditure must also qualify as a research and experimentation (R&E) expenditure under Section 174. For pre-2022 tax years, businesses could fully deduct R&E expenditures in the year the expense was incurred. The TCJA removed the option to fully deduct R&E expenses, instead requiring taxpayers to capitalize and amortize them over a five-year period (or 15 years for foreign research), beginning with the midpoint for the taxable year in which the expenses are paid or incurred. As a result, taxpayers with U.S.-based R&D activity may only deduct 10% of R&E costs in year one, as opposed to 100% under the pre-TCJA regime.

In 2023, Congress took meaningful steps toward enacting a legislative “fix” to the Section 174 capitalization issue. In the House of Representatives, the American Innovation and R&D Competitiveness Act, which has garnered the support of 113 Republican and 100 Democrat co-sponsors thus far, is under review by the House Ways and Means Committee. Meanwhile, in the Senate, the American Innovation and Jobs Act has attracted 41 co-sponsors, split almost evenly across party lines. Both bills call for restoring the immediate expensing option for R&E expenditures and would apply the amendments retroactively to tax year 2023. Given the momentum behind both bills, we are hopeful that Congress will deliver a legislative “fix” to mandatory capitalization in the coming months.

179D Deduction: Increased deduction amounts and expanded eligibility for allocations

A powerful tool available to architects to minimize the effects of 174 capitalization is the 179D Deduction. Originally enacted in 2005 and made permanent in 2020, Section 179D saw a major overhaul as part of the Inflation Reduction Act of 2022 (IRA). Specifically, the IRA substantially increased the value of the deduction and expanded the eligibility requirements with respect to architects and other designers. The 179D Deduction incentivizes the design and construction of energy-efficient commercial buildings through a tax deduction that is proportional to the building’s area. Eligible projects include both new construction and renovations and must include improvements to an eligible system: building envelope, HVAC/hot water, or interior lighting.

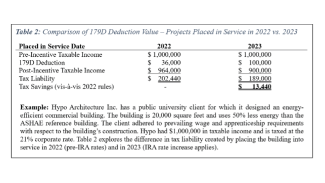

The IRA significantly increased the deduction amount that can be claimed under Section 179D. Historically, the 179D Deduction was capped at $1.80 (adjusted for inflation to $1.88 in 2022) per square foot. The IRA increased this cap to a maximum of $5 per square foot for buildings placed into service in 2023 and beyond — a potential increase of up to 265%! A firm’s exact deduction amount per square foot is dependent on two factors: one, the relative energy efficiency of the building as compared to a reference ASHRAE standard, and two, whether the project satisfied the prevailing wage and apprenticeship requirements.

The IRA also broadened the requirements for allocating a 179D Deduction to the building designer. For most types of energy-efficient commercial building projects, the 179D Deduction is claimed by the building’s owner; however, Section 179D allows “specified tax-exempt entities” to allocate their 179D Deduction to the “person primarily responsible for designing” the corresponding building. Before the IRA, the term “specified tax-exempt entity” was limited to public entities, such as government entities and public schools and universities. The IRA expanded the definition of “specified tax-exempt entity” to include all private non-profit entities, including buildings owned by Native American tribes, private schools and universities, churches, and other 501(c) entities. This presents a great opportunity for architecture firms and other design professionals to capture more value from their projects involving non-profit entities and minimize the effects of mandatory capitalization under Section 174.

Next steps for leveraging tax incentives

Architecture firms can use several tax strategies to offset the impact of mandatory capitalization under Section 174. In particular, architecture firms should consider claiming the 179D Deduction, as this incentive has been recently expanded and provides a different avenue for firms to reduce their tax liability. In addition, firms claiming the R&D Credit should keep their eyes peeled for a legislative “fix” to the Section 174 capitalization issue as promising bills are working their way through both the House and the Senate.

Reach out to BRAYN Consulting to determine if the R&D Credit or the 179D Deduction can benefit your organization.

IRS Circular 230 Disclosure – To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code, or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

AIA does not sponsor or endorse any enterprise, whether public or private, operated for profit. Further, no AIA officer, director, committee member, or employee, or any of its component organizations in his or her official capacity, is permitted to approve, sponsor, endorse, or do anything that may be deemed or construed to be an approval, sponsorship, or endorsement of any material of construction or any method or manner of handling, using, distributing, or dealing in any material or product.