January 2024 Consensus Construction Forecast

After an unusually strong performance in 2023, the construction sector will see weaker conditions this year and next.

After an unusually strong performance in 2023, the construction sector will see weaker conditions this year and next

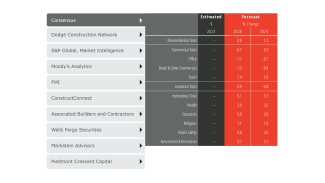

After increasing by more than 20% last year, spending on nonresidential buildings will see a much more modest 4% increase in 2024, at a pace that will slow to just over 1% growth in 2025. Spending on commercial facilities will be flat this year and next, manufacturing construction will increase almost 10% this year before stabilizing in 2025, and institutional construction will see mid-single-digit gains this year and next.

These are key conclusions from the AIA Consensus Construction Forecast panelists, a group comprised of the leading construction forecasters from across the country. This survey provides the most recent update of nonresidential building forecasts for 2024 and provides the first look at 2025.

This past year produced a surprisingly strong performance for the building sector of the economy. The healthy spending rebound of almost 12% in 2022 came on the heels of only modest growth in 2020 and a decline of almost 5% in 2021, before spending accelerated to an estimated 22% in 2023. Manufacturing construction accounted for a large share of these gains as this sector alone produced almost 30% of overall spending on nonresidential buildings last year. However, manufacturing was not the only bright light. On the commercial side, spending on offices was up an estimated 8%, retail and other commercial facilities 7%, and hotels 21%. The institutional sector did equally well, with healthcare and education spending both up an estimated 13%. Religious and public safety facilities each increased at a double-digit pace, and the amusement and recreation category grew to over 8%.

Recently-enacted federal programs provided some of the latest boosts to construction spending on buildings. The CHIPS and Science Act, enacted in August 2022, has boosted manufacturing spending by providing funding to high-tech hubs and semiconductor manufacturing. The Inflation Adjustment Act, also enacted in August 2022, has provided funding for the electrification of homes as well as financial incentives for energy-efficient commercial reconstruction and building. Finally, the Infrastructure Investment and Jobs Act, enacted in November 2021, provides funding for traditional infrastructure, which eventually will encourage more building construction in conjunction with these infrastructure investments.

View interactive data from the Consensus Construction Forecast

Several headwinds facing construction

Even with the additional funding provided by these federal programs, building construction activity is projected to slow. Behind the projected slowdown are several economic headwinds facing this sector, mostly affecting commercial facilities. These include tighter credit conditions, high input costs, falling prices for commercial property values in several sectors, and structural changes in demand for key commercial categories.

- Tighter credit – Rising long-term interest rates, even with their recent easing, has put pressure on many regional banks that account for a significant share of construction lending. As a result, credit standards for construction have tightened significantly. The most recent Federal Reserve Board’s Senior Loan Office Opinion Survey, covering the third quarter of 2023, reports that almost 60% of lenders tightened credit standards for commercial real estate loans over the prior three months. No respondents reported easing them. Tighter credit conditions often are the reason for not moving ahead with a project, or for changing plans during the design phase of a project. ConstructConnect recently reported that its Project Stress Index, which measures the level of delayed, stalled, or abandoned projects, has been moving up sharply in recent months.

- Higher construction input costs – While cost increases for most construction commodities have stabilized recently, inflation remains a problem for the construction industry. Inputs have stabilized at levels 35% to 40% higher than their pre-pandemic rates. While price volatility seems to be under control, there is little likelihood that they will revert to early 2020 levels anytime soon. Additionally, while commodity inputs have stabilized, construction labor costs are still rising at a 4% annual pace.

- Declines in commercial property values – Weak demand has put downward pressure on property values for most commercial sectors. MSCI’s Commercial Property Price Index indicates that multifamily, commercial, and industrial property values have declined 8% on average over the past year. Office values lead the decline, down almost 15% over the past year, but apartments (down 12%) and retail facilities (down almost 7%) have also seen significant declines in property values. Only industrial facilities (up almost 2%) have withstood this downward trend.

- Structural changes in demand – While construction is a notoriously cyclical industry, some of the current trends affecting the office and retail sectors are more structural than cyclical. At present, about 30% of paid workdays nationally are worked remotely. Remote work seems to be stabilizing at around this level. Prior to the pandemic, the share of days working remotely was under 5%, underscoring the need of most companies for less office space. Also, the pandemic gave a boost to e-commerce over traditional brick and mortar retail facilities. E-commerce sales have been increasing at a 15% annual pace and are projected to exceed $1 trillion nationally this year.

The slowdown is already underway

Even though construction spending remains strong in virtually all nonresidential construction categories, other indicators confirm that a construction slowdown is underway. By the latter part of 2023, construction starts had either slowed dramatically or turned negative in virtually all construction sectors. The value of nonresidential building starts increased a mere 2% through the first 11 months of 2023 as compared to the same period in 2022, according to ConstructConnect. Starts in the commercial sector declined 1%, with double-digit declines in retail and warehousing, but were largely offset by growth of 20% in the hotel sector. Manufacturing starts were down 4%, while institutional starts increased by 10%. Within the broader institutional category, education starts increased by 20%, while healthcare starts saw a fairly significant decline.

Architecture firms also saw weaker business conditions last year. Through November of 2023, the AIA’s Architecture Billings Index (ABI) showed declining billings at architecture firms in seven of those months. More significantly, the September through November readings were all in the 44 to 45 range, indicating a more significant decline in billings in those months.

Architecture firm billings are unlikely to rebound anytime soon. New project work coming into firms has also seen a slowdown, with declines each month over the August to November period. These declines in new project work have cut into backlogs at firms. While reaching 7.2 months on average in early 2022, firm backlogs had edged down to the 6.5-month level by the third quarter of last year.

However, the status of billings at architecture firms varies considerably depending on their specialization. Firms specializing in multifamily projects reported strong billings through mid-year 2022. They have been slowing steadily since then, with significant declines by the fourth quarter of 2023. Firms specializing in the commercial/industrial sector likewise were reporting strong growth in billings through mid-year 2022, and modest decline since then. The downturn in billings moderated through most of last year.

Institutional sector offers the most upside

Institutional firms, in contrast, have fared much better in recent quarters, alternating between modest growth and modest declines in billings over the past several quarters. Institutional projects are largely immune from the headwinds confronting commercial and industrial facilities. Funding is generally more heavily dependent on government and nonprofit commitments as well as private philanthropy. Therefore, it is generally more insulated from changing market conditions.

Additionally, institutional projects often are more dependent on broader demographic trends. For example, the number of people in the school and college population will influence the size of educational construction budgets. Also, people aged 65 and older tend to be major consumers of healthcare services and therefore, the number in this age range will influence the need for healthcare facilities. In contrast, demand for commercial and manufacturing facilities is heavily influenced by regular economic cycles and less so by the demographic characteristics of the population.

The AIA Consensus Construction Forecast panelists are expecting relative stability in spending on institutional facilities to follow this pattern. As a result, all the major institutional sectors are projected to see modest growth this year and next. Education and healthcare facilities generally account for about 60% of construction spending in this category. Spending in the education sector is projected to increase 6% this year and 4% in 2025, in part to make up for deferred spending during the pandemic. Healthcare was one of the few major construction sectors that did not see a decline during the pandemic. This pattern of stable growth is projected to continue, producing an increase in spending of around 3.5% annually both this year and next.