July 2024 Consensus Construction Forecast

Midyear update projects construction spending to gain momentum this year, but stall in 2025.

Midyear update projects construction spending to gain momentum this year, but stall in 2025

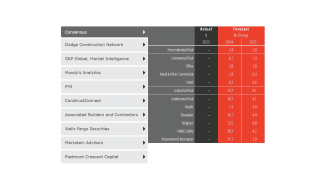

Spending on nonresidential buildings is projected to increase over 7% this year, but then slow to only 2% growth next year. Commercial facilities activity effectively will be flat this year and next, manufacturing construction will increase almost 14% this year before stabilizing in 2025, and institutional construction will see a more than 10% gain this year before slowing to 4% in 2025.

These are key conclusions from the mid-year update by the AIA Consensus Construction Forecast panelists, a group comprised of the leading construction forecasters from across the country. This survey evaluates how this year is likely to shape up from the midyear vantage point, and projects how these trends are expected to play out as we move through the coming year. The figures presented here are in nominal terms, meaning that they are not adjusted for inflation.

View interactive data from the Consensus Construction Forecast

Sector conditions are diverging.

While the overall nonresidential building market is seeing reasonably healthy growth this year, its performance has varied greatly by sector. The commercial sector has seen declines year-to-date as compared to the same period a year ago, while spending on manufacturing facilities has seen strong growth and most institutional sectors have seen reasonably healthy gains.

On the commercial/industrial side, a few key sectors have been generating strong growth while others are stagnating. For example, manufacturing construction currently accounts for well over a quarter of all spending in the nonresidential building sector, a share that has doubled since 2019. Embedded in the generally weak retail and other commercial sector is warehouses, which account for over 9% of spending in the broader nonresidential building category. Its share has increased from just over 6% in 2019. Finally, data centers are categorized within the broader office sector. While traditional office spending has been declining, spending on data centers has been rapidly increasing. Commerce Department figures peg data center spending as accounting for over 3% of the overall nonresidential building market, and its share has doubled since 2019.

In total, these three niche commercial/industrial construction sectors currently account for over 40% of the nonresidential building market, up modestly from their 39% share last year. In 2019, these three sectors accounted for less than 23% of overall nonresidential building activity. As a result, these construction sectors that typically have a different design focus, materials composition, and contractor specialization now account for much of the gain that the industry has seen recently. That would suggest that some segments of the industry have benefited from the strong growth in these sectors, while others have been passed over.

Market challenges continue

Construction spending, while continuing to increase, has seen the pace of growth slow so far this year, and this slowdown is expected to continue through this year and into 2025. Indications of a continued slowdown include a challenging lending market for construction projects, continued weakness in commercial property values, and ongoing softness in billings at architecture firms.

- Challenging lending market – Yields on 10-year treasury bills, typically used as a proxy for construction financing costs, are currently running between 4.25% and 4.5%. While not dramatically different from levels of the past few decades, they have risen significantly from levels seen in recent years. During the summer of 2020, yields hit a low for this cycle at just over 0.5%. They stayed below 1% through early 2021, and below 2% through early 2022. Currently, lending rates are significantly changing the calculations of project feasibility. The Federal Reserve Board’s survey of senior loan officers documents the tighter lending standards for commercial real estate lending. According to their recent report, “a significant net share of banks reported tightening standards for all types of CRE loans. Meanwhile, a moderate net share of banks reported weaker demand for construction and land development loans, while significant net shares of banks reported weaker demand for loans secured by nonfarm nonresidential and multifamily residential properties. The most cited reasons for tightening credit policies on CRE loans were less favorable or more uncertain outlooks for CRE market rents, vacancy rates, and property prices. Additionally, major net shares of other banks cited a reduced tolerance for risk, increased concerns about the effects of regulatory changes or supervisory actions, and a less favorable or more uncertain outlook for delinquency rates on mortgages backed by CRE properties.”

- Continued weakness in commercial property values – A tighter financing environment coupled with weaker demand for most categories of commercial properties continues to put downward pressure on property values. MSCI’s Commercial Property Price Index indicates a 13.5% overall decline in commercial property values since its most recent high in midyear 2022. Offices have seen the steepest decline of over 26% over this period, while apartment values have declined by 21%. Retail facilities have seen a more modest decline of 10%, while industrial property values have continued to increase, tacking on about 5% in value gains over this period. Price declines for apartments and retail facilities are beginning to moderate, but continue to fall quite sharply for offices, particularly in downtown areas.

- Billings at architecture firms – Architecture firm revenue is a very accurate leading indicator of construction spending with a 9-to-12-month lead. Quarterly billings at architecture firms have been declining since the fourth quarter of 2022, according to the AIA/Deltek Architecture Billings Index (ABI). However, the pace of decline – though volatile— has begun to accelerate over the past 10 months. Firms that specialize in the multifamily residential market have seen the steepest downturn in billings, followed by those specializing in commercial/industrial activity. Firms with an institutional specialization have generally seen revenue levels hold steady, although there has been emerging weakness in recent months. Given that both new design contracts and project inquiries at architecture firms have been about as weak as billings, prospects for a turnaround in design activity do not appear to be imminent.

Outlook: institutional sectors help to offset weak commercial markets

Outside of a few niche sectors including manufacturing and data centers, the commercial/industrial outlook is poised at best for very modest growth or more likely declines in spending levels moving forward. The AIA Consensus Construction Forecast is calling for essentially no growth this year and next overall in the commercial markets. For industrial facilities, current project activity is expected to produce healthy double-digit spending growth this year, but then stabilize for 2025.

Most of the institutional sectors offer more potential in terms of growth in the near term according to the AIA Consensus Forecast panelists. The overall sector is projected to increase almost 11% this year, and then record another 4% increase next year. Health care construction, a significant institutional sector, has seen growth throughout the pandemic, and is poised for a 7% gain this year, and an additional 4% next. Amusement and recreation, a sector that understandably saw little activity during the pandemic, is now poised for a double-digit percentage rebound this year, and an additional 4% increase in 2025.

However, expectations are that much of the projected growth in the overall institutional sector will be generated by the education market. Education is the largest institutional component, and accounts for almost one in every five dollars spent on nonresidential building construction. Longer-term, spending on educational facilities is largely driven by demographics, namely the increase in the under age 25 population. There were over 100 million persons under age 25 in the U.S. in 2020. This group is expected to increase by almost two million by 2030. The greatest increases are expected to come from the under age ten population, as the number of 10-19-year-olds is expected to decline between 2020 and 2030, while the 20-24-year-old group is expected to increase only modestly.

However, these estimates may turn out to be too low if immigration numbers were to increase. This decade, the increase in net immigration is expected to outpace the natural increase in our population (defined as the number of births minus the number of deaths), and historically children have comprised a large segment of the immigrant population. Additionally, many educational construction and reconstruction projects were put on hold during the pandemic with the increase in remote education, so pent-up demand will push up construction activity levels.

One final consideration that will impact the construction outlook moving forward is the growing importance of reconstruction activity as a share of overall construction spending. Surveys conducted by the AIA have discovered that about 50% of billings at architecture firms come from work on existing buildings, including additions to existing facilities. The current economic environment of declining values of existing buildings coupled with the elevated cost of building new facilities often tilts the scales toward reconstruction over new construction. The expectation is that the reconstruction share of total construction activity will continue to increase in the years ahead.