A new year, a new set of challenges facing architecture firms

By Kermit Baker, Hon. AIA

While this year may end up looking like last year, economically speaking, the reasons are likely to be very different.

At this time last year, architecture firms were focused on the condition of the economy. Given the high rate of inflation and the aggressive actions by the Federal Reserve Board in raising interest rates to slow the economy, a recession later in the year seemed inevitable. However, many firms were short-staffed and had difficulty finding qualified applicants to fill open positions. Given the rampant inflation and general staff shortages, compensation expectations of current staff were also often well above what many firms could afford.

Still, most firm leaders had modest expectations for revenue growth, according to AIA’s monthly Work-on-the-Boards Survey. About a third of firms expected revenue to increase at least 5% over 2022 levels, about a third expected their revenue to decline by 5% or more, and the final third expected revenue to remain effective flat. On average, revenue across the profession was projected to increase less than 1% for the year.

Fast forward to the present, and architects were remarkably prescient in their outlook. Overall revenue was essentially flat across the profession, and just about as many firms reported a revenue decline of 5% or more as reported an increase in revenue of that magnitude. And looking forward, firms expect no revenue growth across the profession this year -- in fact, the overwhelming majority of firms project either healthy growth or a vexing decline.

Same results, different problems

While 2024 may indeed end up looking a lot like last year, the reasons are likely to be very different. Last year saw a booming construction market across most sectors, and industry concerns were centered around spiraling construction costs, escalating staff compensation, and clients’ anxiety during a period of economic uncertainty. This year, there is a growing consensus among economists that the U.S. economy will avoid a recession, that inflation is under control, and that the Federal Reserve Board will be lowering interest rates in the near future.

Last year, architects reported that their biggest concern was coping with volatile construction labor and materials costs and availability of both. This year, that concern barely made it on the list as one of the top ten. Last year, recruiting and retaining staff and dealing with staff compensation issues dominated architects’ top concerns, while this year, these concerns are much further down the list. Instead, with limited opportunities to increase growth, firms are challenged to balance their elevated costs with relatively flat revenue.

“Increasing firm profitability” was selected as the principal challenge facing firms in 2024, according to AIA’s December 2023 Work on the Boards survey, as 30% of firms indicated that this was one of their top three concerns for the year. This was followed by “managing rising costs of running a firm” and “negotiating appropriate project fees.” So, the top three concerns facing firms this year revolve around balancing costs and revenue.

Another set of challenges for the year are about a weakening project workload and concerns over how clients are dealing with economic uncertainty. "Identifying new clients and new markets," "client changes in availability of project financing and higher interest rates," and "on-time payment from clients and managing receivables" were all on the list of the top ten concerns for the coming year, according to the Work-on-the-Boards survey. So, while having more work than a firm could easily manage given staffing constraints dominated concerns last year, having sufficient profitable work is a growing concern for the coming year.

Workloads shrinking

One critical difference at present is that architecture firms are heading into the year with much weaker business conditions. Architecture firm billings weakened in the second half of 2023, according to the AIA/Deltek Architecture Billings (ABI) Index, and saw a sharper falloff in the fourth quarter of the year as they fell to levels not seen since the early days of the pandemic. If the economy can avoid a broader recession, there may be hope of a quick bounce back in architectural billings. However, signs coming from architecture firms are not pointing in that direction.

New design contracts measure the trend in new projects coming into architecture firms and are an important leading indicator of the future level of billings. Over the second half of last year, the AIA’s index for new design contracts has mirrored the downturn in billings. Until new project activity begins to accelerate, firm billings will continue to trend down.

Fortunately, architecture firms were able to build up sizeable project backlogs as design work roared back about a year into the pandemic. As the pandemic set in, backlogs (the amount of work currently in-house) fell to five months, but then ballooned to 7.2 months by the first quarter of 2022, according to AIA data. Given the workload buffer provided by these backlogs, firms felt more comfortable that they were well covered if new project activity stalled. However, backlogs have continued to slip, standing at 6.7 months by the end of 2023, causing additional concerns as new project activity continues to stagnate.

Institutional building projected to outperform commercial sector

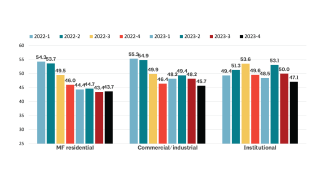

While the overall outlook for design activity has weakened in recent months, some sectors are performing better than others. Multifamily residential activity performed extremely well during the early days of the pandemic as remote workers were looking to expand their housing options. However, as production caught up with demand over this period, rents began to ease, and developers scaled back their plans. Beginning midyear 2022, firms specializing in the multifamily sector began to report revenue declines, a trend that has accelerated in recent quarters.

There has been a similar trend in the commercial/industrial sector, although with considerable variation across building types. The manufacturing sector has been extremely strong, aided by funding under the federal CHIPS and Science Act. Conversely, the office and traditional retail construction sectors have been much weaker due to the prevalence of remote work and the growth of e-commerce. Billings at firms specializing in these facilities began to soften mid-year 2022, but the overall slowdown was much more modest than at multifamily residential firms, according to AIA/Deltek Architecture Billings Index data.

As the ABI tells us, firms focusing on the institutional sector have seen much less of a decline in billings recently than other firms. Institutional projects are largely immune from the problems confronting commercial and industrial facilities. Funding is more heavily dependent on government and nonprofit commitments and therefore is generally more insulated from changing market conditions.

Areas of specialization impact business outlooks

While business conditions and thus the prospects for this year have soured a bit in recent months, there is likely to be considerable variation in firm performance. In a recent AIA Work-on-the-Boards survey, almost 60% of architecture firms are expecting a good-to-great year in 2024. However, almost one in five are expecting a challenging or even potentially disastrous year, with the rest expecting a so-so year. That difference in expected performance may be due to the quality of firm leadership, a firm’s reputation, the effectiveness of its marketing strategy, or other inherent capabilities.

However, a lot of the difference in expectations more likely has to do with a firm’s size, location, and specialization. For example, more than four times as many firms with billings over $5 million a year are expecting a good or great year as are expecting a challenging or potentially disastrous one. For firms with annual billings of $250,000 this ratio is less than two-to-one.

Though somewhat less extreme, there is also regional variation in expected performance this year. Firms in the Midwest region are considerably more optimistic about the prospects for the year. Firms in the Northeast and South are more pessimistic. In terms of specialization, firms with a majority of their billings from institutional projects are much more optimistic about the upcoming year than those that concentrate in the multifamily residential or commercial/industrial sectors.

No doubt there is considerable overlap in these categories. Larger firms are more likely to be designing large institutional projects. Firms in the Midwest likely have a higher share of work in the manufacturing sector, one of the hottest construction sectors in recent years. Nonetheless, a firm’s project mix has a direct influence on their likely business success.

Ultimately, the strength of the various components of the construction industry will be the key driver of a firm’s success. The commercial sector is expected to be very weak this year and next, largely due to structural weakness in demand for office and traditional retail space. Federal incentives for high-tech manufacturing have boosted the industrial sector, which is expected to remain strong before weakening in 2025. The institutional sector is expected to remain reasonably healthy both this year and next based on solid activity in the education and healthcare sectors.

Join Kermit Baker, Hon. AIA, and AIA President Kimberly Dowdell, AIA, NOMAC, for a discussion on Q1 insights about the AIA/Deltek Architecture Billings Index on February 14.