ABI May 2024: Business conditions at architecture firms continue to soften

Few architecture firms report recent work on construction megaprojects

Business conditions remained soft at a majority of architecture firms around the country in May.

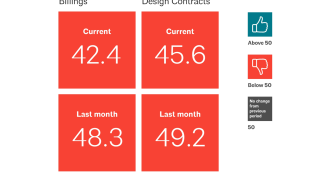

The AIA/Deltek Architecture Billings Index (ABI) score declined to 42.4 for the month, as more firms reported a decrease in billings in May than in April. In addition, there is increasing softness in the pipeline of new work coming into firms. While inquiries into new projects continued to increase, they did so at a slower pace than in recent months. And the value of new signed design contracts declined further in May, following a small decrease in April. Despite the fact that the high inflation of the last few years has largely receded, elevated interest rates continue to cause hesitation among many clients.

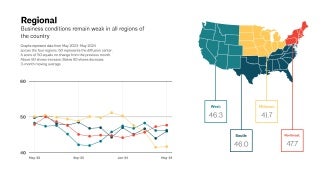

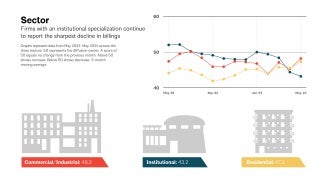

Firm billings remained soft across all regions and sectors as well in May. Billings declined at firms in all regions of the country for the fourth consecutive month, as conditions remained weakest at firms located in the Midwest. Business conditions also softened further in May at firms with an institutional specialization, while fewer firms with commercial/industrial and multifamily residential specializations reported a decline in billings in May than in April. However, a majority of firms of both specializations still reported weak business conditions.

Architectural services employment softens

Conditions remained somewhat mixed in the broader economy in May. The latest edition of the Federal Reserve’s Beige Book report, released on May 29, reported that while overall national economic activity increased in April and May, there remained some variation by region and industry. Overall, credit remained tight and interest rates remained high, which together constrained growth in lending. But outlooks were generally more pessimistic than in recent prior reports. And while commercial real estate generally softened, housing demand rose modestly, and single-family residential construction increased on average. The report also noted that commercial and residential real estate activity weakened in the Boston district after improvement earlier this year, while commercial real estate activity was mixed in the Atlanta district and flat in the San Francisco district. However, commercial and residential construction improved in the Minneapolis district, while overall construction and real estate activity increased modestly in the Chicago district.

Employment was a bright spot in the economy in May, with nonfarm payrolls increasing by 272,000 new positions, above predicted gains. While the unemployment rate has crept up in the last year, it now stands at 4.0%, still just modestly higher than the 3.7% rate from one year ago. However, architectural services employment continued to soften in April, the most recent data available, shedding an additional 100 positions. Industry employment now stands at 205,300, which is 3,000 below the most recent high point in July 2023.

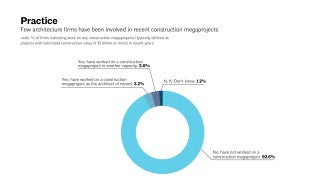

Majority of architecture firms have little experience with megaprojects

With increasing coverage of construction megaprojects (typically defined as projects with estimated construction value of $1 billion or more) in recent months, this month we asked our survey panel of architecture firm leaders about their involvement in these types of projects. Overall, just 6% of responding firm leaders reported that their firm had worked on a construction megaproject in some capacity in recent years. This share was slightly higher at firms located in the Midwest (9%) and West (8%), and at the largest firms with annual billings of $5 million or more (14%), as well as at firms with an institutional specialization (10%). Of the firms that reported working on a megaproject, 3% reported that they worked on the project as the architect of record, and 3% reported that they worked on it in another capacity, such as design and production support, or as a consultant.

At the handful of firms that worked on megaprojects in some capacity, nearly one third of firms (29%) reported that these were mixed use projects, followed by 19% that worked on healthcare megaprojects, 14% that worked on infrastructure megaprojects (e.g., airplane terminals), 14% that worked on industrial megaprojects, and 10% that worked on amusement and recreation megaprojects. Other responses that were mentioned by multiple respondents included justice/correctional facilities and convention centers.

Overall, the majority of architecture firms have little experience with megaprojects. Slightly more than one half of responding firm leaders (51%) indicated that they do not know how the share of total construction activity from megaprojects in recent years has changed in their region, regardless of whether they have worked on one directly or not. Of the firms that were familiar enough to answer the question, 31% believed that the share has increased and 36% believed that it has remained about the same. One in ten firms believed that total construction activity from megaprojects in their region varies a lot from sector to sector, while 18% thought that the share of construction activity from megaprojects in their region has decreased in recent years. The remaining 5% answered some other response, including that their region is too small for any megaprojects.

This month, Work-on-the-Boards participants are saying:

- “New project opportunities have slowed and our marketing hit rate is down. We are hoping our strong backlog will carry us through this apparent slump.”—25-person firm in the Northeast, institutional specialization

- “The last 30 days have seen an uptick in activity.”—85-person firm in the South, residential specialization

- “Generally positive, with public projects maintaining progress and movement. Private sector projects (except for megaprojects) have slowed a bit.”—51-person firm in the Midwest, institutional specialization

- “Remains steady to busy in specific data center and semiconductor sectors.”—6-person firm in the West, commercial/industrial specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.