ABI October 2023: Business conditions continue to soften at architecture firms

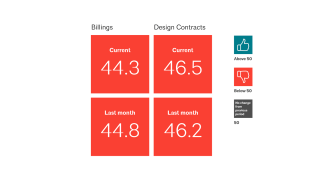

Business conditions at continued to soften in October 2023, with the ABI score declining to 44.3. Read more & subscribe to the Architecture Billings Index.

On average, firms project a slight increase in net revenue this year, and a slight decline in 2024

Business conditions at architecture firms continued to soften in October, with the AIA/Deltek Architecture Billings Index (ABI) score declining to 44.3, as more firms reported decreasing firm billings than in September. In addition, indicators of future work in the pipeline stumbled as well, as firms reported a decline in inquiries into new projects for the first time since July 2020, and the value of newly signed design contracts softened for the third consecutive month. These signs mean that not only are billings declining at firms, but that fewer clients are exploring and committing to new projects, which could affect future billings as well.

Billings were universally soft across the entire country in October, with firms located in the West and Northeast continuing to report the softest conditions overall for the second month in a row. The pace of the decline remained slower at firms located in the Midwest and South but marked the third and fourth consecutive month of declines, respectively. By firm specialization, billings declined only modestly at firms with an institutional specialization, but business conditions remained extremely weak at firms with a multifamily residential specialization, and continued to soften significantly at firms with a commercial/industrial specialization.

Architecture services industry continued to shed jobs in September

There are emerging indicators of weakness in the broader economy as well. Nonfarm payroll employment added just 150,000 new jobs in October, following average monthly gains of 258,000 over the previous year, and on the heels of remarkably strong growth in September. And the architecture services industry continued to shed jobs in September (the most current data available), declining by an additional 500 jobs. While employment in the industry remains higher than at the start of the year, it has declined by 2,600 jobs since the most recent peak in July. Meanwhile, the latest edition of the Federal Reserve’s Beige Book report, released on October 18, indicated that economic activity was largely unchanged from early September, with overall conditions varying by region and industry. Overall, the inventory of homes available for sale remains low, and real estate conditions were generally flat. While construction remained relatively steady in the Philadelphia district, multifamily construction slowed, and financing remained challenging for new commercial projects. Construction and real estate activity declined somewhat in the Chicago district, while construction remained sluggish in general in the New York district, despite strong multifamily construction activity in New York City.

Firm leaders largely expect net revenue to be flat this year

This month we asked firm leaders about current and future revenue trends at their firms, as well as expectations for firm expenses over the coming year. Overall, responding firm leaders indicated that they expect net revenue to be essentially flat at their firm this year, growing by an average of just 0.5%, with only slightly more firms projecting an increase in their revenue from 2022 (44%) than projecting a decrease (37%). Larger firms are somewhat more likely than small firms to expect an increase in net revenue this year (48% of large firms with annual revenue of $5 million or more, versus 43% of small firms with annual revenue of $250,000 or less), for an average projected increase of 1.6%, versus a projected decline of 3% for small firms. Firms with an institutional specialization are also much more likely to project revenue growth this year, with 50% projecting an increase for average growth of 3.4%. This stands in contrast to firms with a multifamily residential specialization, where net revenue is expected to decline by 3.3% this year, and firms with a commercial/industrial specialization, where net revenue is expected to be unchanged from 2022.

Compared to firm leader expectations at the beginning of the year, slightly more than one third of responding firm leaders (35%) indicated that their current estimates are in line with their expectations, while 41% indicated that their current estimates are less than expectations (including 16% who reported that their current estimates are significantly less than their expectations), and 24% indicated that their current estimates are in excess of expectations. And when asked to project their net revenue for 2024 as compared to 2023, responding firm leaders anticipate an average decline of 0.6%. The only firms expecting an increase in revenue in 2024 are large firms with annual billings of $5 million or more, who project net revenue growth of 0.9%, and firms with an institutional specialization, who project net revenue growth of 1.9%.

When asked about changes in major firm expenses over the coming year, the majority of responding firm leaders indicated that they expect expenses to increase. Most notably, 30% of respondents expect employee healthcare costs to increase a lot, while an additional 48% expect them to increase a little. One in five respondents expect the cost of technology for design purposes to increase a lot, and an additional 53% expect them to increase a little. In addition, 66% expect the cost of technology for business purposes to increase, 65% expect liability insurance costs to increase, and 59% expect expenses related to employee benefits other than healthcare to increase. Office space was the only expense where the majority did not expect an increase: 59% expect those expenses to remain about the same, while 35% expect an increase. And firms reported enacting a variety of tactics to better cope with increasing firm expenses, with more than one third (35%) indicating that they are deferring capital investment like technology, 22% reporting that they are outsourcing technical and support services, and 11% reporting cutting back on office space.

What ABI October 2023 Work-on-the-Boards participants are saying

- “Urban mixed use market sector continues to stall, while our convention center and education market sectors are very active.” —143-person firm in the West, institutional specialization

- “There’s a lot of ‘froth’ (RFPs, conversations with developers, etc.), but no one seem to be pulling the trigger on real, large projects.” —75-person firm in the Northeast, residential specialization

- “Things seem to have slowed down since the summer, and we are working on backlog projects. Fewer project leads and calls coming in, and new projects seem to be fewer and smaller. Hoping this is a year-end slowdown, but we are preparing for a slower 2024.” —8-person firm in the South, commercial/industrial specialization

- “Significant volume of awarded projects on hold, primarily in the commercial market. There is also a significant volume of proposals submitted with award decisions on hold.” —130-person firm in the Midwest, institutional specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.